Fun Way To Budget

A tool I find helpful for business and personal is YNAB – You Need A Budget. It’s the first budgeting tool that I actually use on a daily basis. Yes, I know a budgeting tool that you actually use!!

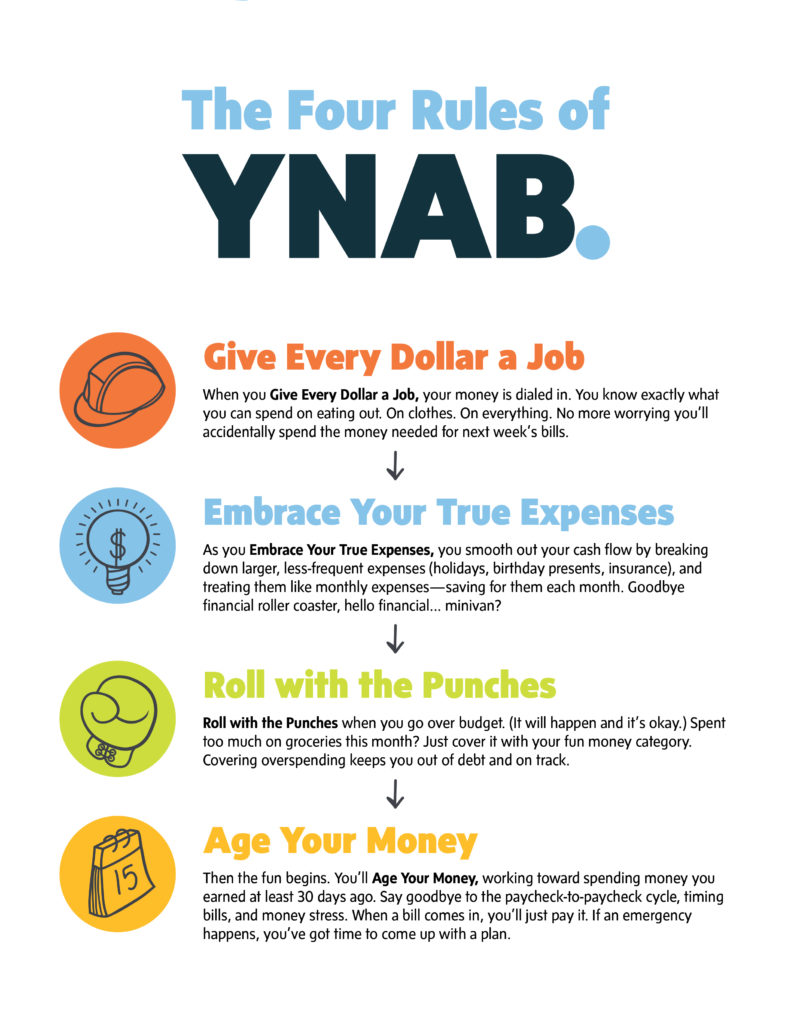

In today’s post I want to focus on the four easy and fun rules that YNAB uses that totally make sense to me. Oh, and yes, I did say fun and budget in the same sentence!!

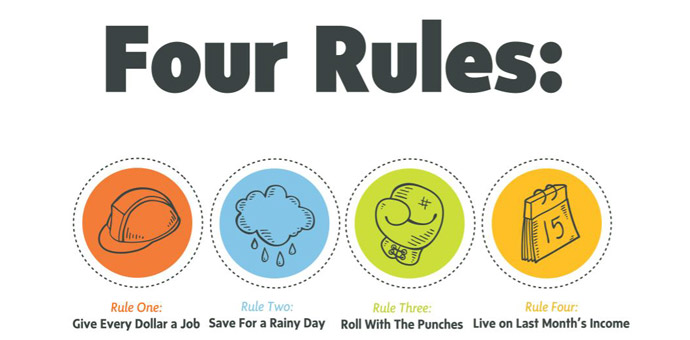

Rule One: Give Every Dollar a Job: This is my favorite because I’m in control of what my dollars are going to do instead of my money controlling me. Make them work for their keep; give them a specific job!

How it works: As soon as you get money, you assign where it will go and what it will be used for. You decide what it needs to do and whatever is most important to you. Because you have a plan for each of those dollars instead of deciding to buy something based on a whim, you’ll decide based on the plan YOU put into place for those designated dollars.

Rule One Summary

- Get some dollars.

- Give those dollars a job!

- Follow your plan.

Life Without Rule One (from YNAB website): Your $500 account balance leads you to believe you’re flush with cash, so you spring for sushi. (And you go big.) But a few days later some bills come due and you don’t have the money. (Because you ate it.) You’re officially stressed.

Life With Rule One (from YNAB website): You have $500 in your account and assign every dollar a job by dividing the $500 into various categories. When a friend invites you to sushi, you consult your Eating Out category (with a $10 balance) and suggest your friend come over to your place to split a pizza instead. A few days later, some bills come due–and you just pay them. (or go to a cheap happy hour)

Rule Two: Embrace Your True Expenses: Make your money boring. Emergency fund is funded, check! Christmas and other gifts; no problem got money stashed away! No credit card needed. Imagine never (ever) dreading the arrival of a large bill again.

How It Works: This is where we plan in advance for those large, maybe annual bills, or less-frequent expenses. We save a little bit each month for those bills and wahlloa, time to pay, no problem!!

Rule Two Summary

- Find a big, infrequent expense.

- Create a goal to fund it monthly.

- When that expense arrives, just pay it!

Life Without Rule Two (from YNAB website): You have $1000 in your account. After some quick (probably faulty) math, you tally your bills. Total (in your head): $770. You’re flush with cash! $1000 minus $770 = $230 of free money! But you forgot about your insurance premium ($600), so now you’re stressed. Credit card to the rescue—and just like that you’re even deeper in debt.

Life With Rule Two (from YNAB website): You looked ahead six months in advance. You’ve been budgeting $100 every month for the insurance premium. Now it’s due, and you have $600 ready to go. Where did the “extra” $100/month come from? When you follow Rule One and start giving every dollar a job, your money starts to obey. It lines itself up with your priorities. It’s not magic, though it feels that way. So, that cRaZy month, that would have sent you into complete and utter panic mode, was no big deal. Kind of boring, actually.

Rule Three – Roll With The Punches: In boxing, you move your body in the same direction as your opponent’s punch to lessen the blow. Same rules apply to budgeting. Be flexible and address overspending as it happens. (from YNAB website)

How It Works: When you overspend in a budget category, just adjust it accordingly. You can remove money from another category into the overspent. Don’t feel guilty, learn, move on and budget accordingly the next time. Remember, you are in control of the job your money has.

Rule Three Summary

- Choose a category with overspending.

- Move funds from another category to cover it.

- Move on without guilt!

Life Without Rule Three (from YNAB website) : When you overspend, you feel like a failure. Budgets don’t work. This whole idea of trying to “guess” what you will spend, is a complete waste of time. You don’t “need a budget,” you “need a raise.” If you only earned just a bit more money, everything would be fine! (Those last two sentences are dripping with sarcasm.)

Life With Rule Three (from YNAB website): You overspend (it happens) and your budget nudges you—in an überfriendly voice—“Whoops! You overspent on Groceries. No worries! Just move over some surplus money from your Travel category. Good to go!” You don’t feel like a failure or tempted to quit. Budgets do work. You’ve just never budgeted like this before.

Rule Four: Age Your Money: The goal is to have money set aside up to 30 days, thus using money that is 30 days old or older. Then you spend money that is old instead of just coming in!! More money equals less stress.

How It Works: Using the other three rules you will be on purpose on how you spend, save, and allocate your money. You will learn to consistently spend less than you earn, and will be prepared for the future. Eventually, you’ll be able to cover May’s rent with dollars from April. Your money will be at least 30 days old and you’ll wonder how you ever lived without the Four Rules!!!!!

Rule Four Summary

- Be purposeful in your spending.

- Consistently spend less than you earn.

- Watch that Age of Money grow!

Life Without Rule Four (from YNAB website): John lives paycheck to paycheck. He knows the date of his next paycheck well in advance and has a stack of bills he’s timing to go out as soon as the paycheck hits his account—a stressful juggling act. He’s habitually anxious and frantic and can’t stop thinking about how much he needs a vacation. But who has money for that?

Life With Rule Four (from YNAB website): John has at least a month’s worth of paychecks budgeted before the month even starts. Lots of money, just sitting around, waiting to do its job. When bills arrive, he pays them—actually, he put them on autopay a couple months ago. He’s habitually happy and content and can’t stop thinking about the money he plans to invest and next summer’s vacation.

Test drive YNAB and get ready for a new year of budgeting fun in 2020!!!